Remodeling your bathroom can add significant value to your home. Your bathroom remodel cost in Columbus, OH will depend on size, fixtures, materials, labor, and other factors.

Home Value Rating: 3/5

An ADU yields moderate returns that you can maximize with the help of a pro.

You can earn a return on your investment if you rent out the space.

ADUs that add living space will almost always improve home value.

ADUs that can be easily converted back are least likely to reduce home value.

Adding an accessory dwelling unit (ADU) to your home can negatively affect your home value or drastically improve it. On average, you can expect an ROI of 50%, but that could go up to and beyond 100% if you rent out the space and earn monthly income as a result. Building an ADU costs an average of $180,000, and prices can range widely from $5,000 up to $300,000 or more.

Understanding how your ADU project will affect your home value and potentially provide additional returns is crucial before you get started, so let’s discuss the ROI you can expect to see.

An accessory dwelling unit (ADU) is a small, independent residential unit on the same lot as your main home or apartment.

Adding an ADU to your home can provide no monetary returns and actually decrease your home value in some cases, and in others, it can improve your home value and provide more than a 100% ROI over time. The reason there’s such a large disparity here is that there are many factors at play when it comes to added value and returns.

How you intend to use your ADU is the most influential factor when estimating ROI.

Installing an ADU for personal use, like giving guests, family members, or close friends some privacy when they visit, is more likely to detract from home value than add to it. Unless you find a buyer who happens to want the exact broken-up layout you establish for your ADU, chances are the buyer pool will look at the changes as something negative. They’ll need to lay out money and time to return the house to its original condition before they can move in, so they’ll likely be willing to pay less.

On the other hand, installing an ADU that you plan on renting to a tenant may decrease value for the same reasons if the eventual buyer wants the living space for themselves. Even so, you’ll have rental income in the meantime, which can easily pay for the cost of adding the ADU and then some. In the best-case scenario, you’ll have rental income that more than pays for the ADU and provides an ROI of over 100%, and the buyer you find will also find value in having a rentable space and be willing to pay more for your home.

| Intended Use | Expected ROI |

|---|---|

| Private | 0%–80% |

| Rental | 100%+ |

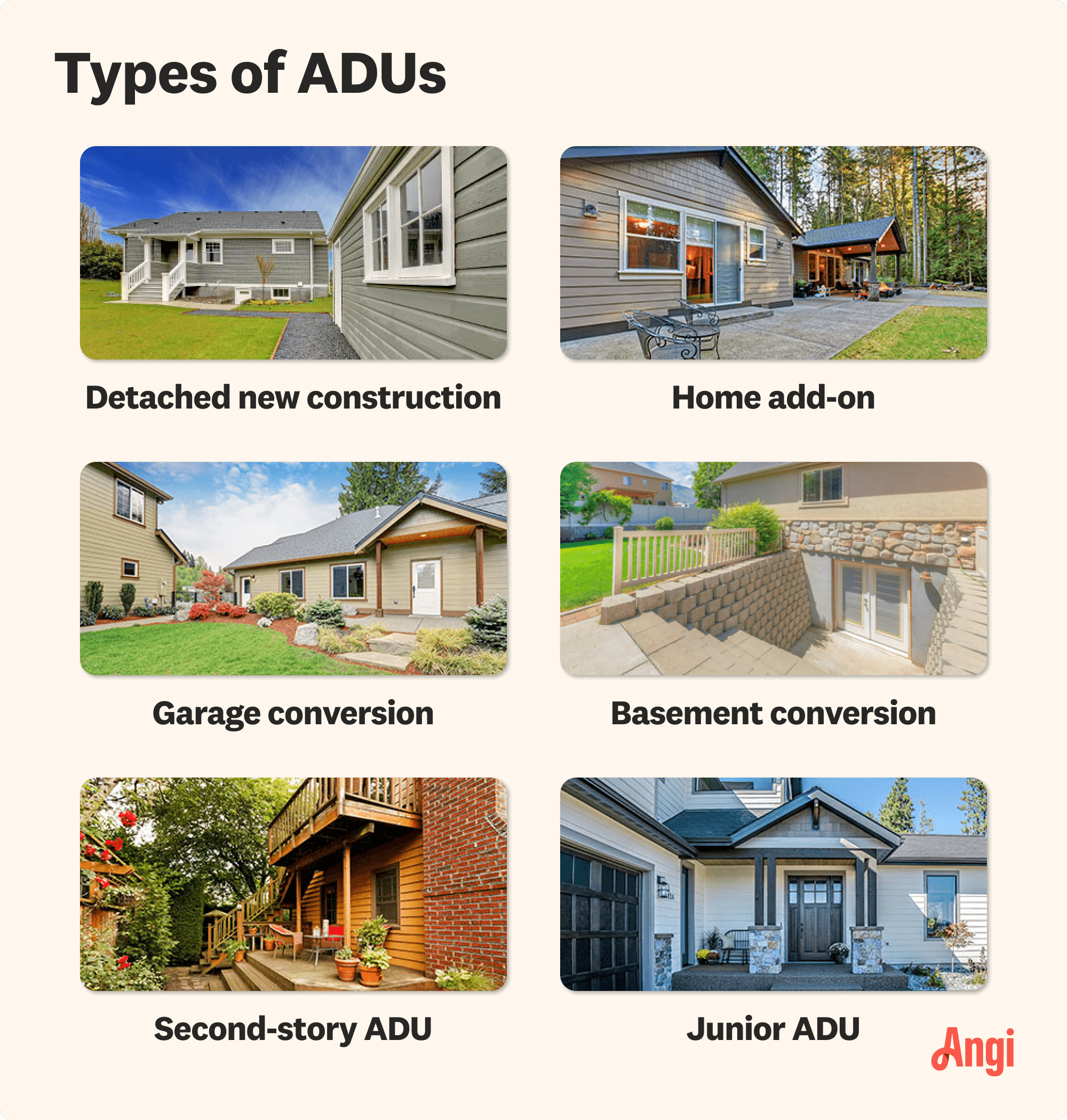

There are a few different types of ADUs that fall under three broad categories: conversion ADUs, new construction detached ADUs, and new construction attached ADUs. The type you decide on will change how your ADU affects living space, yard size, and more.

| Type of ADU | Expected ROI |

|---|---|

| Conversion | Under 0%–100%+ |

| Detached New Construction | 70%–100%+ |

| Attached New Construction | 70%–100%+ |

Conversion ADUs are those that involve converting an existing space to a private living area. They include garage conversions, basement conversions, attic conversions, and junior ADUs.

Garage conversion ADU: This involves converting an attached or detached garage to an ADU. You lose parking space, but adding livable square footage will usually lead to a higher home value and a greater ROI.

Basement conversion ADU: This involves converting a finished or unfinished basement to an ADU. This could lower your home value if you convert a finished basement to a separate living space, but going from unfinished to finished will leave you with an ROI of 70%, on average. Your return could be lower if the buyer decides they want to remove a kitchenette or make changes to the layout.

Attic conversion ADU: This is similar to a basement conversion but instead converts an attic to a living space. Finishing an attic provides an average ROI of 50% to 70%, but again, that number could be lower if the buyer needs to make changes post-closing.

Junior ADU: A junior ADU or in-law suite is a semi-private space that shares a bathroom and sometimes an exterior entrance with the main home, so it’s mostly for family members and close friends rather than tenants. A junior ADU is more likely to provide a negative ROI, as buyers are unlikely to want to keep the layout as-is after they close.

These types of ADUs don’t create or take away living space or yard space, so they tend to be the easiest to convert back and have the smallest impact on your actual home value. Your ROI, however, will still depend on how you’re using the unit.

New construction detached ADUs involve building a new structure that stands apart from your main home. These include bungalows, tiny house ADUs, and cottages. They’re the most expensive to install, reaching up to $300,000 or more, so it will take longer to see a positive return.

Adding living space will almost always increase home value, and new construction detached ADUs are the easiest and most convenient to rent, so you’re likely to see an ROI of between 70% and 100%. Your total return could go much higher if you rent out the space prior to selling.

A new construction attached ADU involves building a new structure that’s attached to your existing one. This can include adding a second story to a one-story home or building a home addition off the side.

Much like a detached ADU, this won’t detract from your existing living space and will only serve to add square footage, so you’re likely to see a boost in home value. You’ll also have the opportunity to rent out the space for an even higher return that grows past 100%. Installing a home addition costs an average of $51,000 and falls between $22,000 and $84,000 in most cases, so it’s more affordable than installing a detached ADU.

The size of your ADU will affect how much value it adds to your home. It costs between $80 and $210 per square foot to add new living space to your home and added living space provides an average ROI of between 50% and 80%. That means each square foot of living space you add should bump up your home value by $40 to $170.

Remodeling existing living space costs between $15 and $60 per square foot. With an average ROI of 60% to 100% for a conversion ADU, you’re looking at adding between $10 and $60 per square foot to your home’s value.

In some cases, the size of your property can affect the ROI you’ll see from building an ADU, specifically a detached new construction ADU. In most cases, adding living space drives up property value, but if you sacrifice most or all of your yard for the unit, you could end up doing yourself a disservice. Buyers may not need a detached living space, so they’d likely prioritize a yard area over a detached ADU.

The rental market affects the returns you’ll see on your ADU installation if you plan on renting the space and if the buyer who ends up purchasing your home plans on renting it, as well. ADUs in areas with strong rental markets, which tend to be in coastal areas and on the outskirts of major cities, will see higher average returns for rented units.

When you sell your home, it can also affect your ROI, especially if you have a rentable ADU. When home prices and mortgage rates are high, more people will rent, which means savvy buyers who want rentable space in their new homes will likely pay more for your property. When homes are affordable, and mortgage rates are low, more people can afford to buy, which means the demand for homes with rentable units decreases.

With so many moving parts to consider, it’s hard to say with certainty what kind of return you’ll see when investing in an ADU. There are a few things you can do and consider to get a better idea, though.

Hire an appraiser: Getting the opinion of an appraiser is a great option if you’re concerned about negatively affecting your home’s value. Hire an appraiser to provide an as-is value and an “as-repaired” value, which, in your case, will be the value with the ADU added.

Ask a local real estate agent: Local real estate agents may be willing to help you figure out if adding an ADU is in your best interest. They can consider the rental demand in your area and properties on the market to estimate your long-term returns.

Look at comparable properties: Look for properties in your area that have ADUs and try to get a sense of how they’re priced compared to properties without them.

Consider the average rental rates in your area: Check local rental listings to see how much you could rent your ADU for. This can help you figure out your annual returns from rental income before you take the sale price into account.

Ask a local contractor: Consult with a contractor in your area who builds home additions to see what your project would cost. You can use that figure to determine if it’s worth the investment.

The average cost to build an ADU is $180,000, and most projects fall between $60,000 and $285,000. Junior ADUs that just require minimal interior work to partition off a portion of the existing living space can cost under $5,000, while high-end detached bungalows can top $300,000. The price depends mostly on the type of ADU you’re building.

| Type of ADU | Cost Range |

|---|---|

| Attached new construction | $100,000–$216,000 |

| Attic conversion | $60,000–$150,000 |

| Basement conversion | $60,000–$150,000 |

| Detached new construction | $110,000–$285,000 |

| Garage conversion | $60,000–$150,000 |

An ADU can be well worth the investment if you plan on renting the space and earning a monthly income. Renting the ADU while you live in the main unit can pay for itself in just a few years, and if the ADU adds value to your property, you’ll also see a return when you eventually sell. This could mean an ROI well in excess of 100%.

It can also be a worthwhile investment from a utility point of view if you host family or friends often and want them to have a dedicated place to stay to give you and them more privacy. However, the ROI is likely to be much lower without the added rental income.

From average costs to expert advice, get all the answers you need to get your job done.

Remodeling your bathroom can add significant value to your home. Your bathroom remodel cost in Columbus, OH will depend on size, fixtures, materials, labor, and other factors.

The cost to add a bathroom takes into account whether it’s a half or full bath, square footage, plumbing, electrical, and more. Read on for a cost breakdown.

An updated bathtub can give a bathroom a whole new look. Find out how much it costs to replace a bathtub, including prices by type and labor costs.

An updated bathtub can give a bathroom a whole new look. Find out how much it costs to replace a bathtub in Minneapolis, MN, including prices by type and labor costs.

Learn how to build a DIY dog wash station to make your pup’s bathtime a less backbreaking job that leaves your family bathroom free from dog hair and dirt.

The chances of slipping and falling in the shower increase with age and limited mobility. Here are the types of shower grab bars and safety rails that can keep you safe.