Remodeling your bathroom can add significant value to your home. Your bathroom remodel cost in Columbus, OH will depend on size, fixtures, materials, labor, and other factors.

Let your home help pay for its upgrade

A home equity loan lets you borrow against the equity you’ve built in your home.

Your home acts as collateral for the loan, so you risk losing your home if you don’t pay on time.

The best way to use a home equity loan is to make improvements to your home that increase its value.

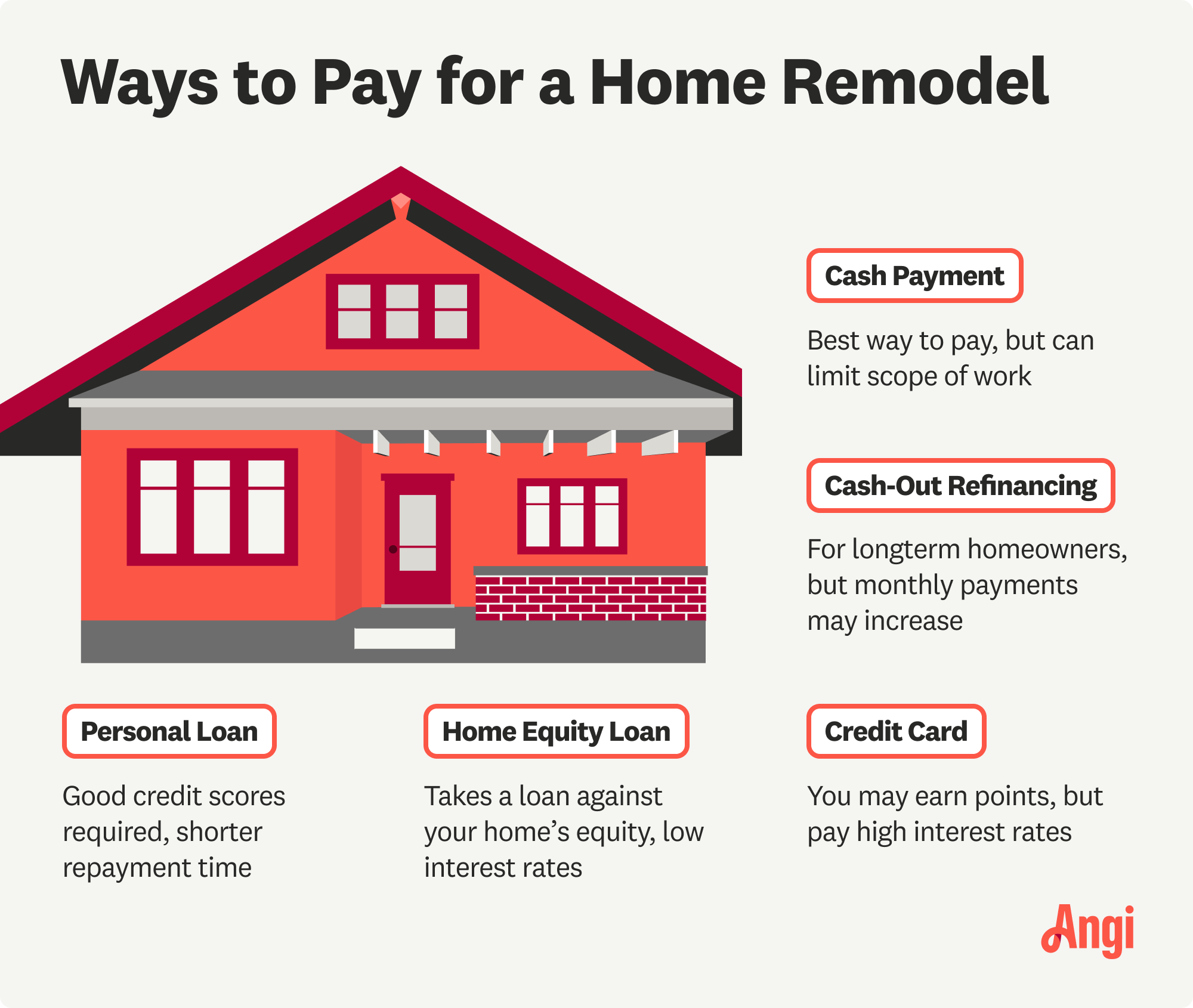

If you’re thinking of making significant home improvements, it’s helpful to understand how a home equity loan for remodels works. This financing method allows homeowners to borrow money against their equity, with their home acting as collateral. A home equity loan is a smart way to fund your remodeling project because it has a much lower interest rate than a credit card.

A home equity loan is a loan that makes it possible to borrow against any equity you built in your home. Your home equity is the difference between the current market value of your home and the remaining balance on your mortgage. If you purchase a home in cash, your equity is the entire value of the home (if you were to sell it). If you already paid down a significant portion of your mortgage or your home has appreciated in value, you may have a substantial amount of equity to borrow against.

When you take out a home equity loan, you receive a lump sum of money up front, which you repay over a fixed term with set monthly payments. The loan’s interest rate is often fixed, meaning your payments stay consistent throughout the life of the loan, making it easier to budget for. Home equity loans are often used for large expenses like debt consolidation, higher education, or home renovations.

There is a catch—your home acts as collateral, which means if you fail to make your payments on time and default on the loan, the lender can seize your home.

It’s easy to see why so many homeowners turn to home equity loans when it’s time to refresh their homes. Not only is this a convenient and affordable loan type, but it can also allow homeowners to afford significant improvements that can increase the value of their property.

Here are the steps to take if you're considering this financing option for your renovation project:

Evaluate your home’s equity: Before applying for a home equity loan, assess how much equity you have in your home. Lenders often require that you maintain at least 15% to 20% equity after the loan is taken out, so the amount you can borrow depends on your home’s current value and mortgage balance.

Create a detailed renovation plan: Outline the scope of your remodel, including a breakdown of costs for materials, labor, and any unexpected expenses. Lenders often want to know how you plan to use the loan, and a detailed plan can help ensure you borrow the correct amount. You don’t want to overborrow with a home equity loan since that will lead to higher monthly payments. It’s never a good idea to put your home at risk. You can work with a home remodeling professional near you to get an idea of how much your project will cost.

Shop around: Different lenders offer varying interest rates and loan terms, so it’s important to compare options. Shop around to see which lender can offer you the lowest interest rate so you don’t accidentally overspend.

Make a repayment plan. Do not drag your feet on repaying a home equity loan. Of course, making the minimum monthly payments is a necessity, but if possible add room to your budget to make extra payments so you can pay off the loan faster and save on interest charges. When deciding how much to borrow, think of a home equity loan as adding renovation costs to your mortgage to determine which expenses are worth it.

Before taking out a home equity loan to help finance a remodel, consider both the advantages and disadvantages of doing so carefully.

Fixed interest rates: Home equity loans come with fixed interest rates, which means your monthly payments won’t fluctuate, making budgeting easier.

Lump-sum payment: You receive the total amount up front, which can help you cover large renovation expenses all at once.

Potential tax benefits: In some cases, the interest paid on a home equity loan used for home improvement may be tax-deductible. Consult a tax professional before taking out the loan to see what potential tax benefits are waiting for you if this perk is important to you.

Increased home value: If used wisely, a home equity loan can fund renovations that increase your home’s value, helping you build more equity over time.

Risk to your home: Since your home acts as collateral, failing to make timely payments could lead to foreclosure.

Long-term debt: A home equity loan increases your overall debt, which can be burdensome if your financial situation changes unexpectedly.

Closing costs: Home equity loans often include closing costs, including appraisal fees, origination fees, and more—all of which add to the total borrowing cost and renovation budget.

Limited borrowing potential: You can only borrow against the equity you’ve built in your home. If you haven't owned your home for long or your home hasn’t appreciated much, your borrowing power may be limited.

From average costs to expert advice, get all the answers you need to get your job done.

Remodeling your bathroom can add significant value to your home. Your bathroom remodel cost in Columbus, OH will depend on size, fixtures, materials, labor, and other factors.

Various factors affect the total tub-to-shower conversion cost, including the size of the area, type of shower, materials, and labor fees.

The cost to install a window seat depends on several factors, such as materials, labor, and options. Here’s a breakdown of the cost to install a window seat.

Working from home is only productive if you have a dedicated office space. Learn the cost to build a home office, from materials to labor rates.

An updated bathtub can give a bathroom a whole new look. Find out how much it costs to replace a bathtub in San Francisco, CA, including prices by type and labor costs.

DIY sink installation is a doozy but do-able for those with experience. Use this guide to learn how to install a bathroom sink in a few steps.